Now you can’t be the Wright Brothers, who built the airplane. You can’t be Thomas Edison either, who invented the electric bulb. Even if you can’t create something from scratch like them, you don’t have to be sad. You can take inspiration from others, add or subtract something from their ideas, or modify them to create something new.

Now you might say, “Yes, why not? We are experts in this.”If this thought comes to your mind that you can do this work just like that, then go ahead and achieve your goal.There is just one small condition for that. You should have a passion for that work within you. Just like an ordinary boy studied Ferrari cars and made a better racing car, Lamborghini. Which has millions of fans today.

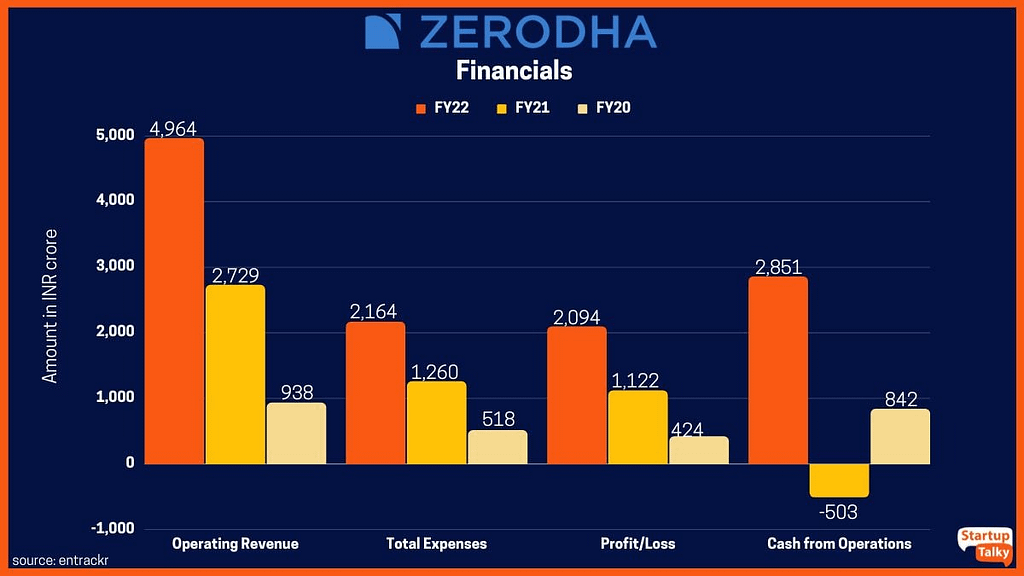

How Zerodha became a 28,000 crore company without any funding

Nithin Kamath was admitted to Dyal Singh Public School for his early education, but he was more interested in other things than academics. At an age when children are busy playing, Nithin started developing a desire to earn money. This curiosity was fueled by his Marwari friends because all of Nithin’s friends came from a Marwari background. Therefore, the influence of his peers on Nithin was natural.

“Sangati se gun hot hai, sangati se gun jaye” – a couplet by Kabir perfectly applies to Nithin. Due to the influence of his friends, Nithin’s inclination towards earning money quickly grew rapidly. Both Nithin Kamath and Nikhil Kamath, the two brothers, wanted to do something that would yield fruitful results on the spot.

In the midst of this desire, Nithin started trading old mobile phones. However, as soon as his mother found out about this business, she confiscated all the phones. As a result, Nithin’s mobile phone business came to an end. After that, by convincing his mother, he started investing money from his mother’s offline trading account.

Like every science student, at the age of only 17 in 1997, Nithin took admission to the Bangalore Institute of Technology for engineering. Nithin did enroll in engineering, but in reality, he was more involved in practical trading.

He spent four years obtaining an engineering degree but excelled in trading. In 2001, he completed his engineering degree, and at the same time, a severe recession hit, causing Nithin to lose all the money he had invested. His dream of becoming like Bill Gates shattered, and all the gods returned to their respective places.

But Nithin was not someone to lose courage so quickly. He had only lost a battle, not everything.Those who are not afraid of stumbling do not climb the mountain. To recover the lost money, Nithin started working at a call center. But his mind was still focused on the stock market.

In 2005, he started his own advisory business. At the same time, he created some groups on Yahoo Messenger and the popular social media platform Orkut, where he shared his knowledge and insights.

One day, somehow Nithin convinced his father to invest in the stock market. After that, he gradually persuaded the call center manager to invest as well. The call center manager was so impressed with Nithin’s work that he marked his attendance even when Nithin was absent.While managing his father’s funds, Nithin spent time with professional traders, learning the intricacies of stock trading. He started waiting for favorable opportunities.

Around the same time, NSE (National Stock Exchange) had launched a free trading platform. This was the turning point in Nithin’s life. Inspired by it, Nithin started Zerodha, a brokerage firm, in 2010.The word “Zerodha” is derived from the English word “zero” and the Sanskrit word “rodha,” meaning “without obstacles.”

The company’s headquarters are in Bangalore, and it is currently the largest brokerage firm in the country. It took Zerodha six years to acquire 70,000 customers and four more years to reach two million customers. By 2022, the company had crossed the milestone of 10 crore (100 million) customers.

Now comes the key point that positions Zerodha at the top.

Bringing it to the number one position are its six supporting pillars:

KITE APP: It is a platform for trading shares. It charges up to ₹20 per transaction, making it the biggest source of revenue for Zerodha.

COIN APP: This platform provides users with the facility to directly buy and sell mutual funds.

VARSITY: This online learning platform offers free tutorials and videos, and Nithin himself writes articles on it.

Rainmatter Startup Incubator: Zerodha initiated Rainmatter in 2015, which is a startup incubator. Through Rainmatter, Zerodha provides assistance to several excellent but small startups in their growth.

True Beacon: Zerodha launched True Beacon in 2019, which offers wealth management services to HNIs (High Net Worth Individuals) and UHNIs (Ultra High Net Worth Individuals).

Kite Connect API: With the help of this API, Zerodha provides a trading platform to retail investors, developers, and startups. They charge a monthly fee of ₹2000 for this service.

Although there are numerous companies in the stock market, Zerodha’s unique business. Strategy of taking minimum charges and targeting mass customers sets it apart. Charging only ₹20 per transaction makes Zerodha distinctive from others.